ESP – S&P Global Announces Modifications to Telecommunications Sector

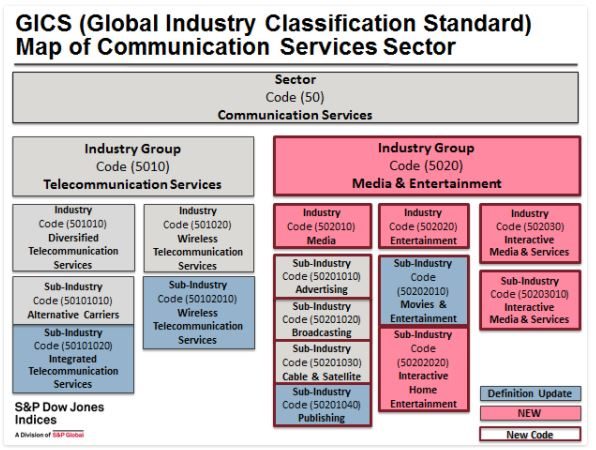

– S&P Global has decided to make the telecom sector more representative of the communications world and include companies that are predominately communications oriented. As more and more companies have become involved in communications the sector designation, telecommunications services, has been uncomfortable. Several communications companies have been “force fit” into other areas that make an investor question the assignment. The change will take place next year in September. There is a very good description of the change proposed in the following write-up from Jodie Gunzburg at S&P Global.

USA Stock Consideration Change Report

CBL & Associates becomes a BUY consideration while American Public Education, Diamond Offshore, HFF, Patterson-UTI Energy, QuinStreet and Rayonier Advanced Materials get a SELL consideration.

Update Economic USA Consumer Credit

Consumer credit continues to show renewed expansion without undue stress in servicing debt. Household debt remains low at 66% of household economic output compared to 87% of 2009.

U.S. Stock Portfolio Considerations (November 2017)

Global Payments, Allegheny Technology and NRG leave the portfolio while Coty, CVS, Kroger and Tyson Foods join.

U.S. Sector Index (ETF) Portfolio Consideration

Some of the changes in asset allocation considerations since last report using the Balanced Target: 1. 0.7 point decrease in Consumer Discretionary, 2. 1.5 point decrease in Consumer Staples, 3. 0.6 point decrease in Energy, 4. 0.8 point increase in Financials, 5. 0.5 point decrease in Health Care, 6. 0.3 point increase in Industrials, 7. 2.2 point increase in Technology, 8. 0.2 point increase in Materials, 9. 0.2 point decrease in Telecom, 10. 0.1 point increase in Utility.