Category: ESP

Source Library: Mid Caps Less Risky Than Large Caps?

Jodie Gunzberg, Managing Director at S&P Dow Jones Indices has written an excellent article about USA MidCap stock behavior. We found it interesting that earlier this year MidCap stocks had become overvalued and well ahead of LargeCap stocks. The MidCap stocks valuation corrected earlier this fall and returned to a lower relative valuation prior to November. In November MidCap stocks demonstrated the signs of lower volatility than their LargeCap colleagues which is discussed in Ms. Gunzberg’s paper. It will be interesting to see if there is a relationship between our relative valuations and increased or decreased volatility within an asset classification.

ESP: Discussion on the Direction of the USD

Daryl Guppy has some interesting thoughts on the U.S. Dollar [USD] that recently appeared on CNBC site.

ESP: Discussion on Whether Dividends are part of Determining Stock Value

Determination of stock fair value at ISN involves the value of dividends in terms of the amount, rate and consistency. We have believed it is a component in determining the overall value and does influence the price investor’s are willing to pay for a security.

ESP: Excellent Discussion About Equally Weighted & Market Weighted Indices

There are specific periods where the S&P 500 equal weight outperforms the S&P 500. This generally happens in cycles and has fundamental underpinnings that support smaller stocks. Interesting times when equal weights underperformed have been in the financial crisis when smaller companies were beaten down by the credit environment, and recently last year when the market was anticipating Trump’s tax cuts but were delayed so the excitement over small caps diminished. In 2017, large caps have outperformed small caps by the most since 1999, which historically does not hold.

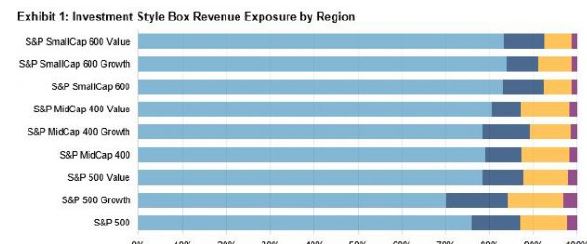

ESP: How Global are the S&P series of Indices?

Frequently, I am asked about the advantages/disadvantage of investing outside of a person’s home or tax base market. My first question is always, “Do you own any index securities”? The answer is usually, yes. When index securities are used in a portfolio the investor is most likely already a global investor. The next decision is how much of an allocation do you wish to direct to outside markets?