USA Stock Consideration Change Report

TransOcean moves into SELL WATCH consideration with Rudolph Tech and SUPERVALU transfers to BUY WATCH, again.

Stock Fair Value Change Report

Revenues and Earnings are the most important influencing factors to this large cap, Information Technology, Software company. Revenues are on track to increase 20$ year-over-year justifying a higher fair value for the company.

ISN USA Stock Coverage Update

Coverage within the ISN stock universe-USA has changed as of today with the addition of: Pacific Premier Bancorp [PPBI], Norwegian Cruise Line [NCLH] and NMI Holdings [NMIH]. Several stocks have been removed due to acquisitions: Parkway [PKY], Level 3 Communications [LVLT] and SciClone Pharmaceuticals [SCLN].

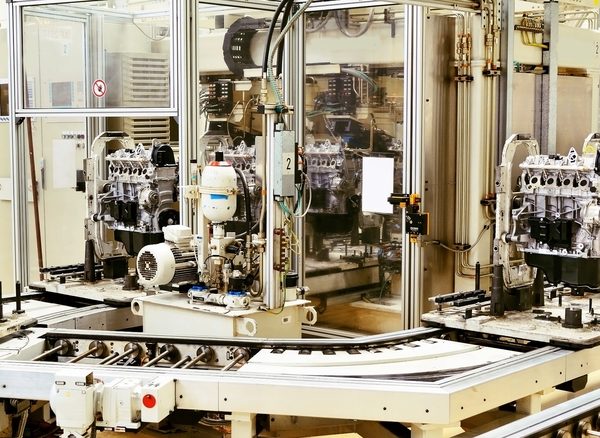

Update Economic USA Industrial Production, Capacity Utilization

Industrial production continues to grow with a 0.2 point increase over last month and 1.6 points from last year. Capacity utilization moved up 0.2% to 76.0% from last month and industrial output advanced 0.1 points. This economic measurement is gradually approaching the long-term average of 79.5%.

ESP – USA Corporate Debt Issuance On Pace for Record Year, David Giordano

Excellent discussion on U.S. corporate debt by David Giodano, Director Fixed Income, S&P Dow Jones Indices, “U.S. corporations continue to take advantage of the accommodative conditions created by a protracted period of low interest rates and strong market participant demand. As of Oct. 1, 2017, U.S. investment-grade corporate debt issuance surpassed USD 1 trillion—three weeks ahead of 2016’s pace. Additionally, the amount of speculative-grade corporate debt issued through the first three quarters of 2017 is 17% higher than it was after the first three quarters of 2016. Combined, U.S. corporate issuance is on pace for another record year, which would mark the sixth consecutive year of increased corporate debt issuance.”