USA Stock Consideration Report (October 2017)

Selling pressure appears to have stabilized after last month’s drop. Midcap has moved well into fair value territory after spending most of 2017 in cautionary levels. Even smallcap lowered the overvalued stress from earlier in 2017 and is now comfortably in fair value range. Both of these market capitalization areas experiencing lower overvalue stress is comforting given the strong total return performance of the most recent 90 days. Smallcap advanced from a loss of 2.44% to a gain of 8.52% while midcap advanced nearly 8 percentage points reaching 10.00% for the year to date.

USA Stock Consideration Change Report

TransOcean moves into SELL WATCH consideration with Rudolph Tech and SUPERVALU transfers to BUY WATCH, again.

Stock Fair Value Change Report

Revenues and Earnings are the most important influencing factors to this large cap, Information Technology, Software company. Revenues are on track to increase 20$ year-over-year justifying a higher fair value for the company.

ISN USA Stock Coverage Update

Coverage within the ISN stock universe-USA has changed as of today with the addition of: Pacific Premier Bancorp [PPBI], Norwegian Cruise Line [NCLH] and NMI Holdings [NMIH]. Several stocks have been removed due to acquisitions: Parkway [PKY], Level 3 Communications [LVLT] and SciClone Pharmaceuticals [SCLN].

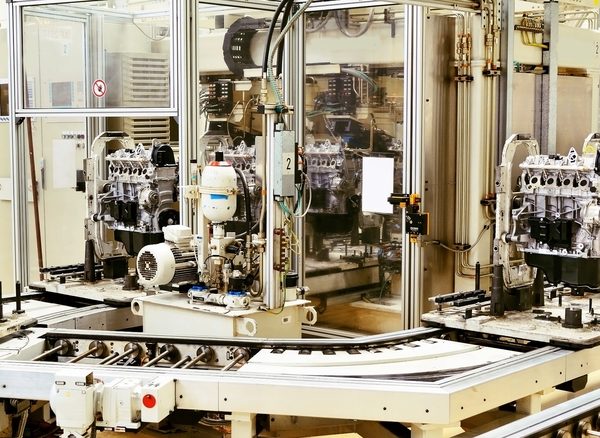

Update Economic USA Industrial Production, Capacity Utilization

Industrial production continues to grow with a 0.2 point increase over last month and 1.6 points from last year. Capacity utilization moved up 0.2% to 76.0% from last month and industrial output advanced 0.1 points. This economic measurement is gradually approaching the long-term average of 79.5%.