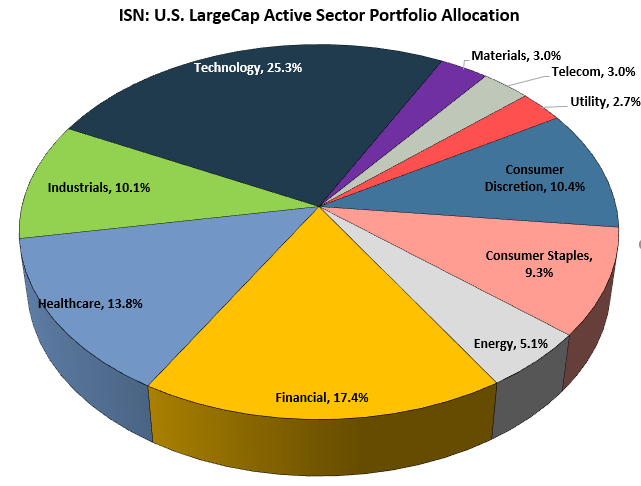

Information Technology remains the largest sector at 24.5% weighting, but drops to 15.1% if Stability is sought.

The portfolio described in this report is designed to provide a market exposure according to the relative fair valuation of each sector within the LargeCap market. Sectors that are currently the most overvalued are reduced in allocation in proportion to the degree of overvaluation while sectors that are the most undervalued will see an increase in allocation in proportion to the degree of undervaluation. This is done to place investments in the area of highest probability of improvement in value.

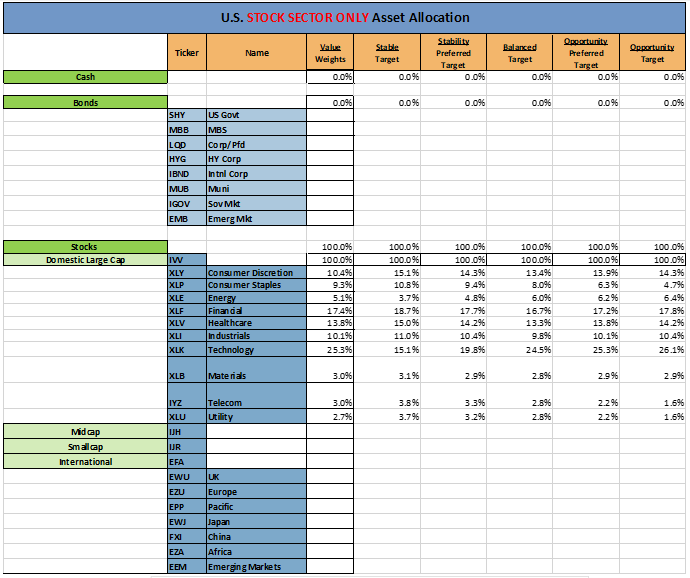

The table in Figure 1 is a recommended asset allocation for a portfolio that would use individual sector index securities or SPDR securities. The allocation amongst the sectors is determined by using the relative fair value for each sector.

Information Technology remains the largest sector at 24.5% (Balanced) which is a decrease of 0.4 percentage points from the last report followed by Financials at 16.7% which is slight decrease of 0.4 points. The next four largest sectors are close in size: HealthCare at 13.3%, no change (<0.2 points) from the previous report, Consumer Discretionary at 13.4%, an increase of 0.6%, Consumer Staples at 8.0%, a reduction of 0.4, and Industrials at 9.8%, no change. Energy increased by 0.6% to 6.0%. While Telecommunication Services remained the same along with Materials and Utilities

This allocation results in a market weight, or near market weight (<0.5 percentage point difference) condition for: Industrials, Information Technology, Materials, Telecom and Utilities. Overweight positions for: Consumer Discretionary, Energy, and Health Care. Underweight positions for: Consumer Staples, and Financials.

The largest change in allocation was in the Stable side of portfolio weightings. If Stability is sought, Information Technology weightings are reduced significantly (15.1% vs. 24.9% earlier and market) as technology stocks stability ratings continue to drop. Once Balanced characteristics are sought, portfolio weights are closer to market weightings. The same is true for Aspirational portfolios.