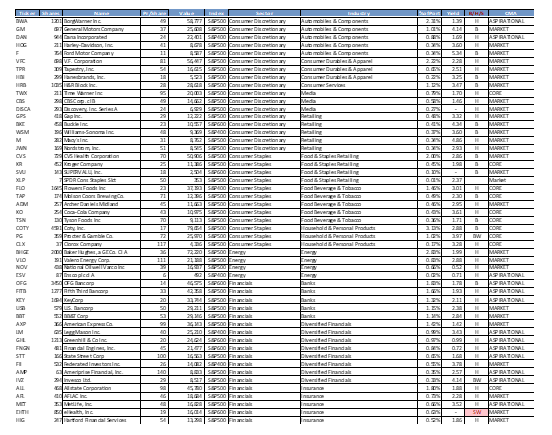

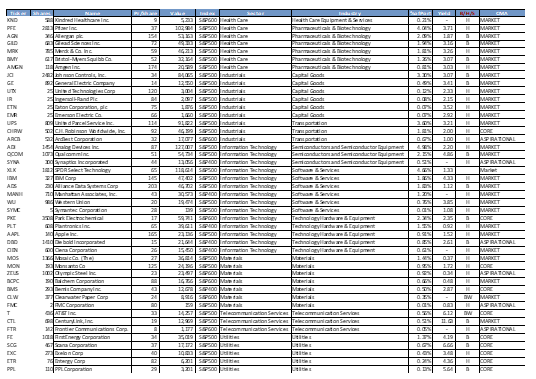

Hess and Marathon Petroleum become Overvalued and Leave the Portfolio Model.

The U.S. Stock Only portfolio model had two stocks that became overvalued this month. Both, were energy stocks: Marathon Petroleum [MPC] at 145.55% Fv and Hess Corporation [HES] had reached 146.1% Fv.

Marathon was a strong contributor to the portfolio gaining 72.2%, while Hess contributed nicely at 18.2%. Both stocks were added to the portfolio in early 2016.

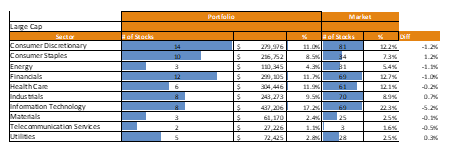

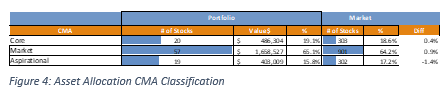

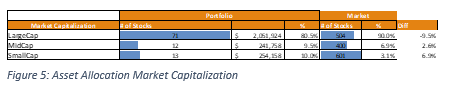

With the two stocks removed from the portfolio the current asset allocation had an underweight position to LargeCap stocks (80.2% vs. 90.0%). Within sector allocations the portfolio was underweight in Energy by 1.5 percentage points, but ended up with a larger underweight position in LargeCap, Information Technology of 6.7 percentage points.

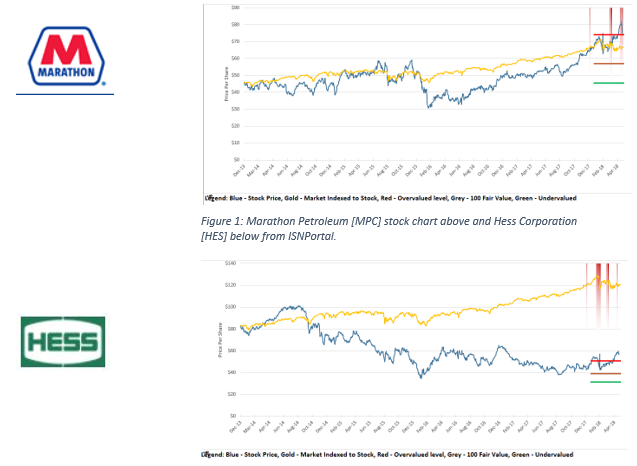

Ideally, we wanted to add to the LargeCap market capitalization area and within the Information Technology sector. There were several stocks that were considered BUYs that meet the criteria. The list was narrowed down to one stock, Alliance Data Systems Corp [ADS]. Alliance was a new addition to the portfolio.

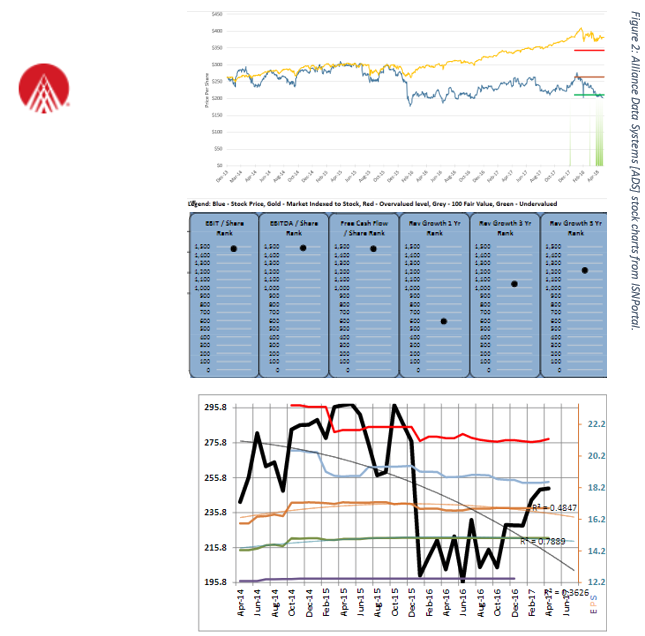

Alliance Data Systems was a LargeCap stock in the software and services industry with information technology. It had a current fair value of $264/share placing the fair value rating at 76.9%. It had strong rankings in EBIT/Share, EBITDA/share and Free Cash Flow/Share. Earnings estimates were also showing increases in expectations.

The plan was to reinvest the money from the sale of Hess and Marathon Petroleum, plus dividend income that has been coming into the portfolio into Alliance Data Systems. This amounted to approximately $48,000 in total.

Adding ADS placed the portfolio on target for Core and Market classified stocks and moved the portfolio closer to the Aspirational target.

The portfolio still has an underweight position to LargeCap, and an overweight position to SmallCap and MidCap areas. These areas have improved, but remain outside of our ideal targets

Investing in Information Technology was designed to reduce the existing 6.7% underweight to LargeCap technology. The buy of Alliance Data has successfully reduced the underweight to 5.2%