Investment Strategy Network has started to provide the economic influence of USD trade weighted index factor on the ISN Portal for individual stocks.

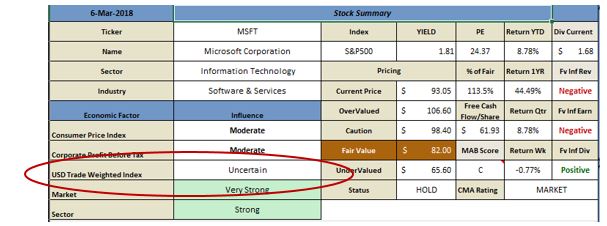

Today we are starting to show the influence of the US$ on U.S. stocks within the database. Each individual stock’s data sheet will now have a notation titled USD Trade Weighted Index. Figure 1 provides a cutout of the table that is available through the stock search menu option.

The USD Trade Weighted Index is a weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners. The currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia.

We are using this as a general market indicator in terms of the impact currency changes have on the market as a whole. Additional economic factors will be added throughout the year to the service.

The USD Trade Weighted Index has been classified into one of four categories: Very Strong, Strong, Moderate and Uncertain. As new economic factors are added to the ISN Portal we will make a service announcement.