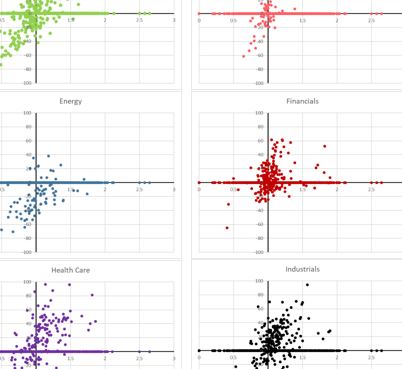

U.S. Sector Map Plot

Sector map plot graphically displays each sector stock constituents in a two dimensional map. The horizontal axis is the return year to date and the vertical axis shows the fair value of the individual stock. In future reports the direction of each sector will be shown with and arrow on a compass rose.

U.S. Stock Consideration Change Report

21st Century Fox is dropped from BUY consideration and Cardinal Health with Scana is placed on the BUY WATCH consideration list. Perry Ellis is now on the SELL WATCH consideration list.

U.S. Stock Portfolio – Update

The U.S. stock only portfolio had one stock that reached an overvalued level and has been retired from the portfolio. The stocks is Diamond Offshore.

USA Stock Consideration Change Report

Acadia Healthcare, Cato, Endo International, Envision Healthcare, Foot Locker, Frontier Communications, Owens & Minor, Red Robin Gourmet, Viacom all move to join the BUY consideration list while Faro Technology, Globus Medical, Primerica and William Lyon Homes move to SELL consideration.

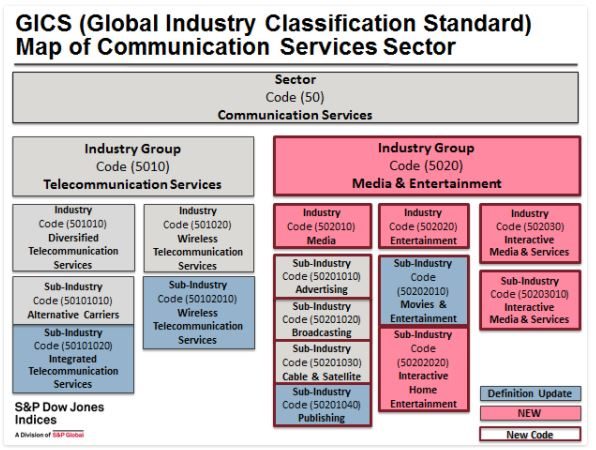

ESP – S&P Global Announces Modifications to Telecommunications Sector

– S&P Global has decided to make the telecom sector more representative of the communications world and include companies that are predominately communications oriented. As more and more companies have become involved in communications the sector designation, telecommunications services, has been uncomfortable. Several communications companies have been “force fit” into other areas that make an investor question the assignment. The change will take place next year in September. There is a very good description of the change proposed in the following write-up from Jodie Gunzburg at S&P Global.