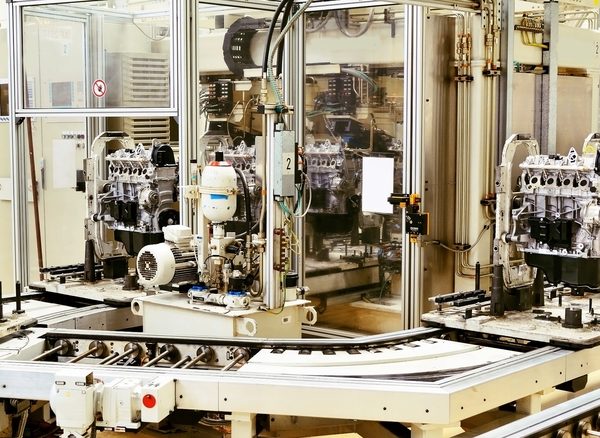

Category: U.S. Economy

Update USA Industrial Production, Capacity Utilization

Industrial production continues to grow with a 1.1 percent increase over last month. Capacity utilization moved down 0.1% to 76.6%. This economic measurement is gradually approaching the long-term average of 79.5%. We have added capacity utilization to this chart so that the month to month changes in industrial output can be viewed in concert with capacity utilization.

Update USA Unemployment 1st Time Claims

Employment jobless claims for 1st time requests is continue to fall. Recent jobless claims were down another 8,000 for the week. The rate is now at 237,000 which is well below the 300,000 unofficial benchmark. Additionally, the 4-week average remained nearly flat at 243,000 close to the same as the previous week and now at a 44 year low. Continuing claims remained below $2 million for 9 straight weeks.

Update Economic USA Agriculture

USDA has completed the most recent estimate on key agriculture components which reflect continued moderation in food related prices to consumers.

Update Economic USA Inflation PPI

After a sizable increase in producer prices last month, prices moderated with a slight drop reaching 2.4% annualized. This is a welcome slowdown as recent increases were starting to indicate a potential long term increase that could lead to inflation at the consumer level. With a spread of 0.5% between the CPI and PPI and with several months of trending increases, the Fed may decide to raise bank rates today in an effort to return to “normal” interest rates. Normal bank interest rates at the Fed are considered to be 3.0%.

Update Economic USA Inflation CPI

After last month’s increase of 2.2% the consumer price index moderated this month and moved down to 1.9% when measured over the past 12 months. This is slightly higher than the 10-year average of 1.6% and lower than the Fed target of 2.0%. The move was created by a 0.1% drop in May that came about primarily due to reductions in energy overall, and specifically gasoline. Food was slightly up by 0.2%. Energy related products remain the major influence in fluctuations in the index while most other prices remain stable.