Category: Economics

Update Economic USA Housing

Housing sales of previously owned houses fell 2.3% in April to 5.57 million units, but this should not be such a surprise since the previous month reached a 10 year high. Gains over the past 12 months might be more indicative of the continuing improvement in housing with a gain of 1.6%. There is an increasing shortage of houses reflected in the most recent supply level at 4.2 months; a normal market is 6 months. The shortage is pushing median prices up and they have now reached $244,800. Given the longer trend to the upside we believe housing is still improving.

Update Economic USA Consumer Credit

Consumer debt is increasing; that is a fact. However, it has been increasing since 1980 except for a few brief periods. In the early 1990’s there was a period of zero and slight negative growth and then again in 2008 as the mortgage crisis set in. Otherwise, expansion has been the norm. Certainly, the current rate of expansion is higher than most previous time periods which leads to the question of whether or not the consumer can afford the credit outstanding? Is the consumer overextended, or is credit increasing as a result of increased income or confidence?

Update Economic USA Housing

Housing starts declined for the month by 2.6% to a 1.172 million units annual rate. While permits also slowed by 2.5% to 1.299 million unit annual rate. This may initially look to be a troubling market, but when examined on a longer term basis we see a different picture. On an annual basis starts are up 0.7% while permits are up 5.7%.

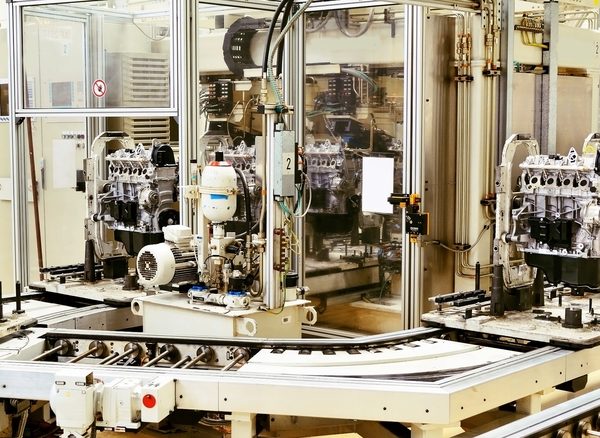

Update Economic USA Industrial Production

Industrial production continues to grow with a 1 percent increase over last month. Capacity utilization was up 0.6 percentage points to 76.7%. This economic measurement is gradually approaching the long-term average of 79.9%.

Update Economic USA CPI

With retail sales advancing for the year we would expect to see an increase in CPI over the next few months. At the moment, overall prices to the consumer are remaining tame, but have advanced by 2.2% which is higher than the Fed Reserve target level of 2.0%.