Investment Strategy Network has started to provide information on the strength of the relationship each stock has with overall consumer credit.

Since Investment Strategy Network started in the mid-1980’s, research on the relationship that exists between individual stocks, markets, sectors and economic factors has been ongoing. As part of the expanding ISN service, we are now providing information about the degree of influence that exists between individual U.S. stocks and overall consumer credit.

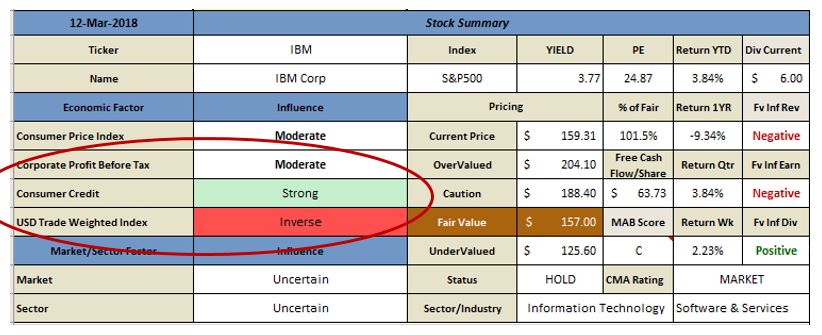

Please see the circled portion of the analysis table below.

Each stocks degree of influence from overall consumer credit has been classified into one of five categories: Very Strong, Strong, Moderate, Uncertain and Inverse. Very Strong and Strong relationships will have a green tint to the cell where the rating is identified. Inverse relationships are marked in red

To make room for additional economic factors we had to move the Sector and Industry information from just under the stock name to the lower right of the table.

.