USA Stock Fair Value Report November

Performance in terms of price return certainly created changes in the year-to-date values as well as last 12 months, quarter and month scores. There was also some welcome relief in relative valuations. Valuations came back closer to Fair Value (100.0% Fv) with reductions of 10 to 24 points.

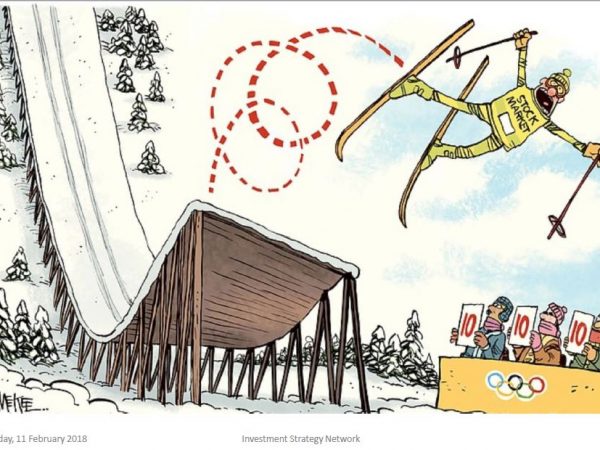

Was Last Week Unusual or Just Another Volatile Market?

A look shows that NASDAQ has more extreme days than the Global Equity Index (kurtosis). Mathematically that is shown by greater SD (1.2%) of the NASDAQ compared to the World Index (0.7%) Not only was NASDAQ more volatile this past week than Global Equities, it was more volatile than its own historical volatility range.

Bruce’s View

The charts presented today represent the last 90 days, the last 5 years and going back to 1969. These are interesting views, especially depending on which time period you wish to concentrate upon. We believe the correct view is a combination of several time periods and an understanding of how the USA market has performed relative to global markets and the underlying economy.

Investment Strategy Today

The overall market is back in fair value at 106.6% Fv with LargeCap the closest to 100% Fv at 104.7% Fv. Expectations have clearly been adjusted and closer to reality.

Investment Strategy Today

Stock price movements took a wild ride during the week ending 26 October and more than usual. The analysis shows how specific sectors were impacted more than the market and greater than normal. Specific stocks were especially unsettling such as Amazon and Microsoft.