Category: Investment Strategy Today

Markets: Snap-Shot: Friday 2 February 2018

MidCap moves out of Overvaluation but LargeCap moves into Cautionary range. All three Capitalization categories are now in Cautionary range.

Markets: Snap Shot: Tuesday, 23 January 2018

In the U.S. LargeCap stocks have taken a slight lead which is somewhat comforting given that they are the category that is the closest to 100.0 Fv at 118.4 Fv. Both, MidCap and SmallCap are not far behind with gains of 4.14% and 4.23%, respectively. It would be comforting if MidCap would slow down a bit as the category is overvalued at 135.0 Fv. It has come back closer to fair value recently, but remains overvalued for now. Previously, MidCap had reached 136.2 Fv.

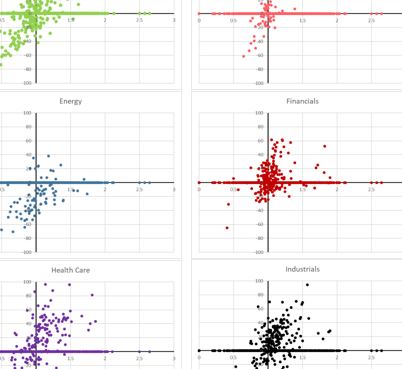

U.S. Sector Map Plot

Sector map plot graphically displays each sector stock constituents in a two dimensional map. The horizontal axis is the return year to date and the vertical axis shows the fair value of the individual stock. In future reports the direction of each sector will be shown with and arrow on a compass rose.

USA Snap Shot

We warned last month that August had a miserable reputation for being unfriendly. Fortunately, the month was not unfriendly, but then it was not friendly either. The market had posted a return of 10.57% as August started and finished at 10.55% for the year. The return was not harmful, but was not beneficial either. However, we will take a drop of only 0.02% for the month and be thankful the month is over.

USA Snap-Shot

Several months ago we were pleased that the DOW closed above 21,000, now we can be even more pleased that it is potentially closing above 22,000 this evening. As I write this brief the DOW is just a few points above 22,000. I also remember when we published our annual market forecast at the beginning of the year when we stated the market had the potential to reach 22,232 and would most likely reach 21, 173. Many said we were unrealistic; it was too high