- Category: Uncategorized

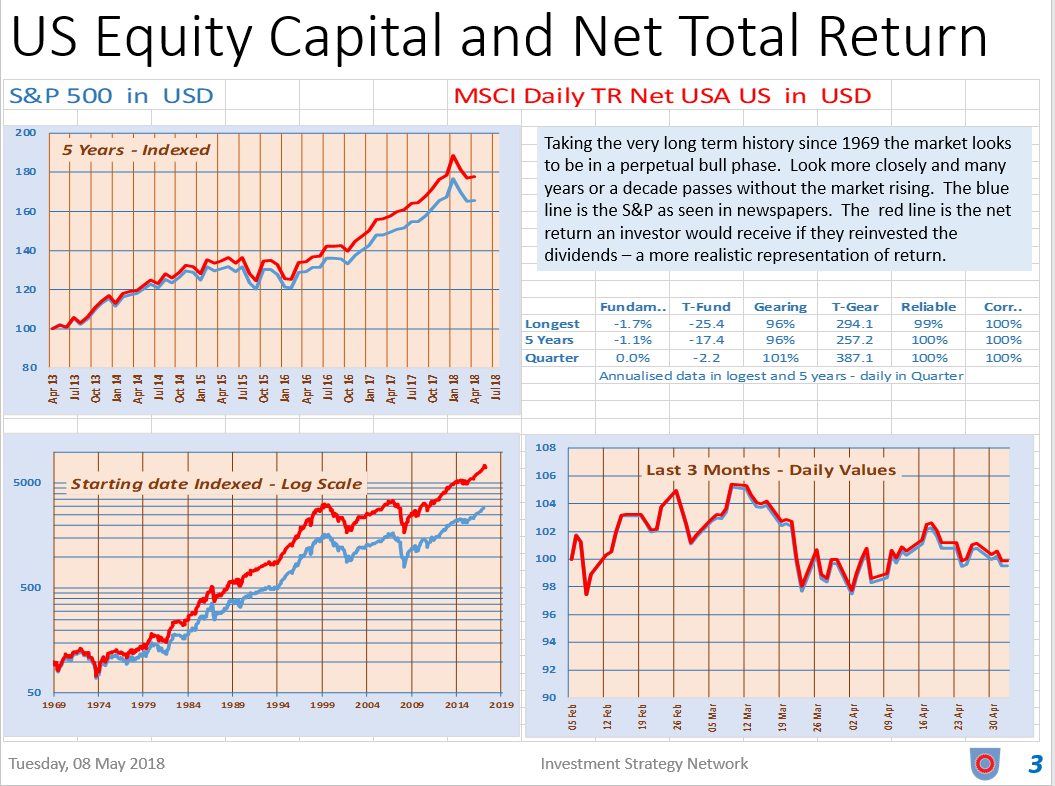

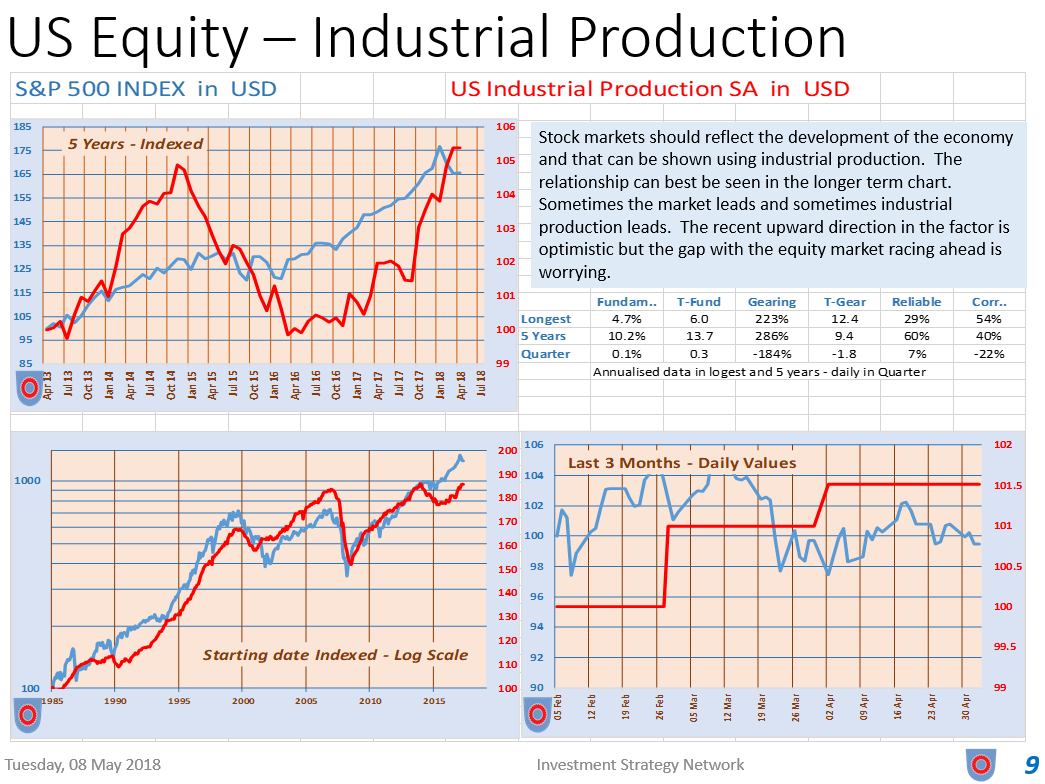

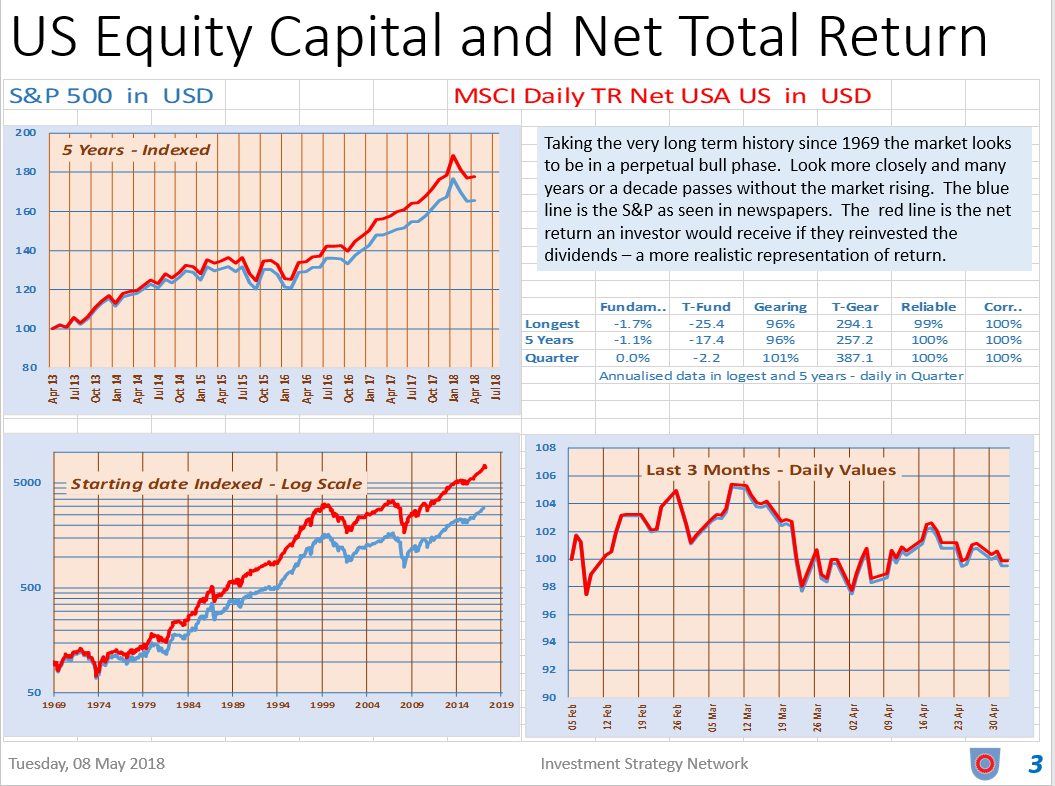

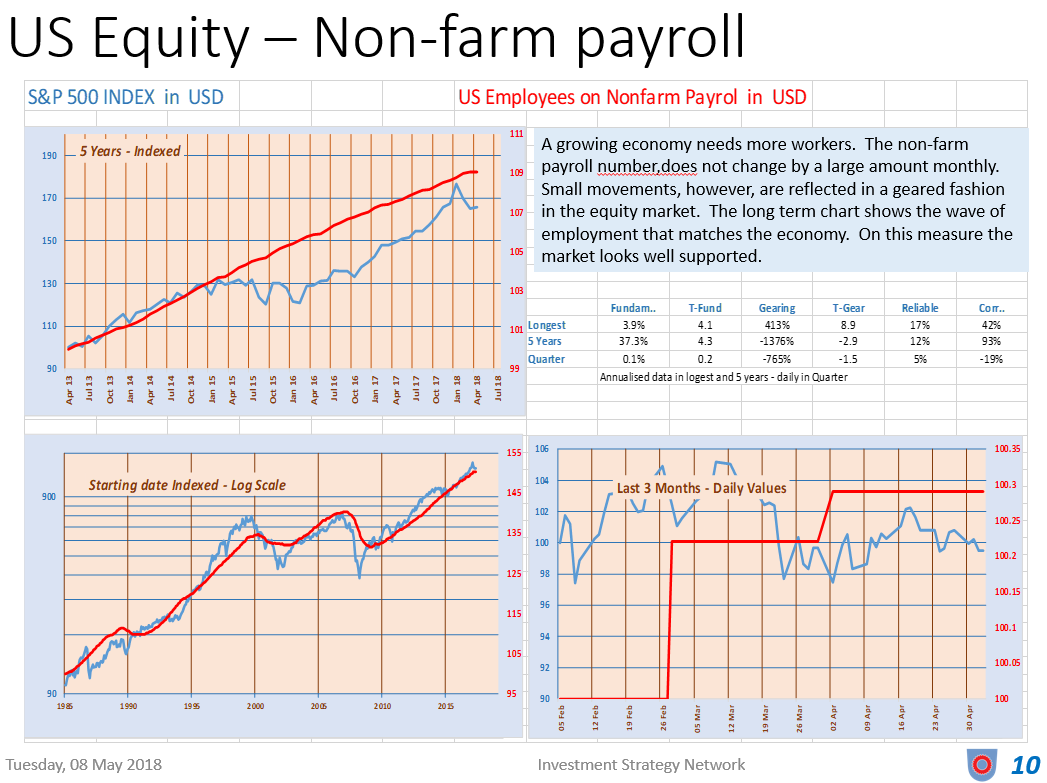

If one has a Rip van Winkle approach we have been in a bull market for the entire period. As it unfolded, however, it certainly did not seem like that. The longest charts begins with a decade of going nowhere but also containing what at the time was a severe crash. With the rate cuts in 1982 a PER multiple bull market began that only ended with the TMT dot com crash. Since then it has been a volatile sideways market until post financial crisis. The slope of the advance is similar to the 1982-2000 period.