USA Stock Considerations Report

Over the past 12 months there have been considerable changes taking place in stock consideration classifications. The most significant changes have taken place in the last 14 days.

Stocks trading in their normal Fair Value range, HOLD, has dropped from 66% to 53%. Roughly half of the total market is trading in their Fair Value range at the present time. Over the past 24 months the shift was from HOLD to SELL WATCH / SELL. This was occurring as investor expectations increased thereby pushing stocks above their Fair Value range. Over the past 14 days stocks have been moving from HOLD into BUY WATCH and

BUY. BUY WATCH has increased 9 percentage points to 10% of the total market. BUY has grown 4 points from 11% to 15%.

USA Stock Fair Value Report November

Performance in terms of price return certainly created changes in the year-to-date values as well as last 12 months, quarter and month scores. There was also some welcome relief in relative valuations. Valuations came back closer to Fair Value (100.0% Fv) with reductions of 10 to 24 points.

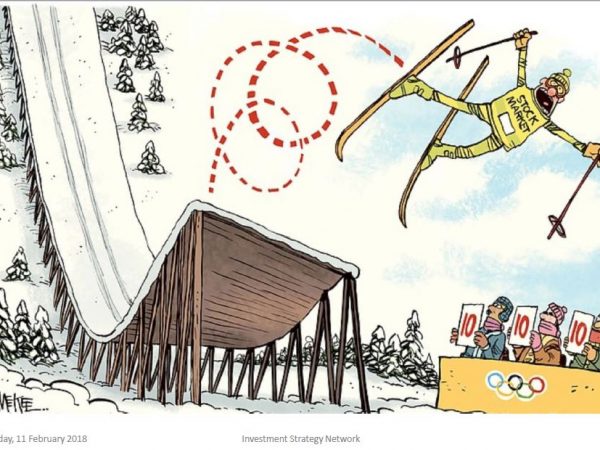

Was Last Week Unusual or Just Another Volatile Market?

A look shows that NASDAQ has more extreme days than the Global Equity Index (kurtosis). Mathematically that is shown by greater SD (1.2%) of the NASDAQ compared to the World Index (0.7%) Not only was NASDAQ more volatile this past week than Global Equities, it was more volatile than its own historical volatility range.

Bruce’s View

The charts presented today represent the last 90 days, the last 5 years and going back to 1969. These are interesting views, especially depending on which time period you wish to concentrate upon. We believe the correct view is a combination of several time periods and an understanding of how the USA market has performed relative to global markets and the underlying economy.

Investment Strategy Today

The overall market is back in fair value at 106.6% Fv with LargeCap the closest to 100% Fv at 104.7% Fv. Expectations have clearly been adjusted and closer to reality.