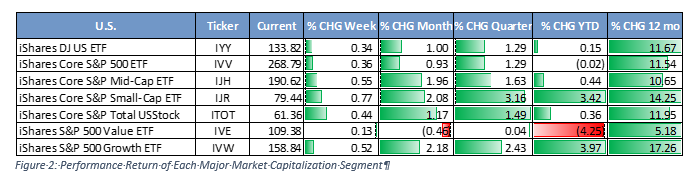

The ride across the U.S. market has been a rough one and we are not moving very far forward. The overall market (AllCap) has only been able to post an anemic 0.36% gain for the year which is only 0.31 points higher than just two months ago. Of the three major market capitalization categories SmallCap has advanced the most by adding 5.22 points to reach a positive 3.42% return after seeing red most of the year. MidCap has also added 2.47 points to put its head above breakeven at 0.44%.

Even though gains are not overwhelming, relative valuations remain optimistic, especially in MidCap stocks. This category has again moved into Cautionary territory at 121.9% Fv. (Cautionary territory starts at 120.0%) SmallCap is not far behind at 118.2% Fv. Investor’s appear to be holding on to their optimism, but there is a definite “wait-and-see” approach to the markets.

On a positive side, gains are better than they were in March when the color red filled most of the performance tables. The gains are not large, but they are gains for the week, month, quarter and year-to-date. Only Value has struggled this year with a loss of 4.25%.

We hate to repeat ourselves but, we would prefer that all three market capitalization categories stay in fair value range for the rest of the quarter. We realize this is not want many investors are seeking as they wish to instantly recover from earlier drops. Let fundamentals catch-up to market expectations.

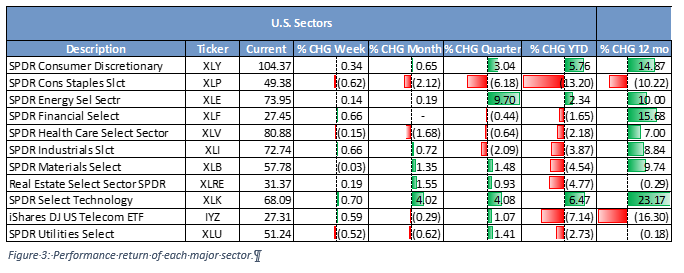

Individual sector performance has been mixed with one-half of the sectors gaining and the other half falling. Energy took top honors adding 10.12 points since our last report turning positive for the year. The sector was severely depressed earlier, down 7.78%. The worst preforming sector is Consumer Staples now down over 13 percent. The real surprise has been in Financials which is currently on the positive side, but only by 1.65% dropping 3.3 points since our last report.

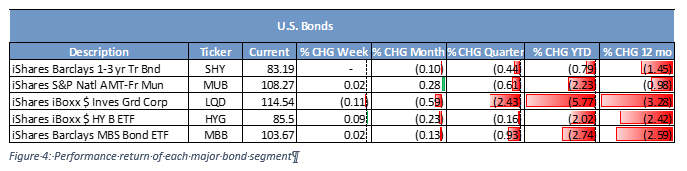

Bond markets continued to bleed red. The only green item from last report turned red making it a unanimous vote this month. Investment grade domestic corporates moved down an additional 1.7 points to reach (5.77%) for the year. Investors that have been waiting for over a decade for higher interest rates will need to wait a little longer. When interest rates started falling as a response to the mortgage crisis many analysts predicted that rates would be low “temporarily”. (We were not one of them.) Maybe they were referring to the historical Japanese temporary low rates?

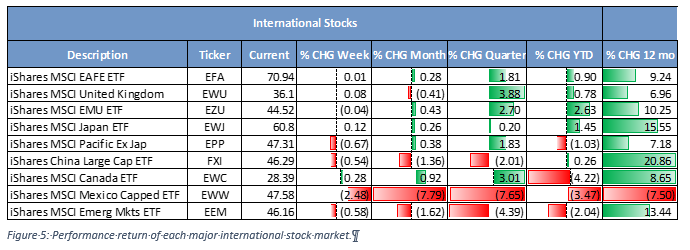

International markets are having equal difficulty with domestic markets. International developed markets overall are struggling to get above 1.0%. Even China has slowed significantly from the previous 12 months and has only added 0.26% so far this year. America’s trading partners are struggling with some of the most negative returns in world markets. Canada has improved since the last report, but they are still down 3.47% for the year.

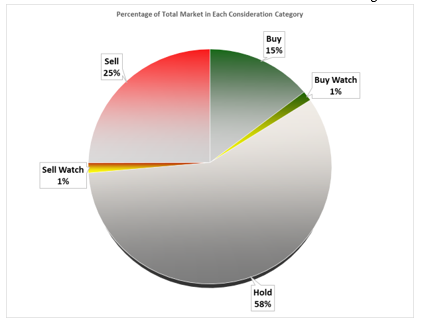

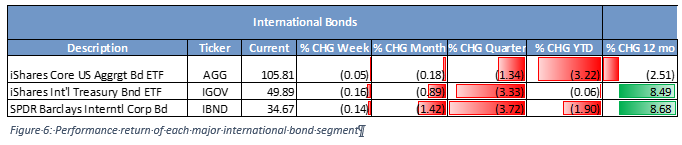

There was no place to avoid the investment malaise of 2019, even international bonds are favoring the negative side of the table. International corporates have dropped nearly 2% and sovereign debt is at breakeven. Over the past several months the market has become increasingly polarized with both Buy/Buy Watch and Sell/Sell Watch categories growing the Hold category shrinks. Sell/Sell Watch has moved to above 25% of the overall market making it slightly larger than the Buy/Buy Watch side at 16%. Hold has lost 4 points since the beginning of the year.