Valuation Pressure is back to normal. Now can the market avoid panic fire?

Year-To-Date stock market performance numbers continued to move lower last week, but stock relative valuations improved. This is good news to a long-term strategic investor; not such good news to a day-trader. If you are a strategic investor, read on. Even though the short-term has been rather disappointing and spread panic throughout the world’s stock markets, there is a realization that over the past 12 months most markets are well above their long-term averages. U.S. LargeCap segment is nearly 5.0 percentage points above the average along with most international markets. U.S. MidCap and SmallCap markets have retreated the most during the February thaw and that was reasonable, given they both were the most overvalued.

Every major market around the world posted lower returns than the previous week. Even China moved to the negative side of the column giving up the coveted position of the best performing market so far this year. Interestingly, Europe has, just barely, moved ahead of China; not bad for a market region that had been given up for eternal mediocre performance and potential bankruptcy just a few short months ago.

U.S. individual sectors all experienced red ink except for Consumer Discretionary which was able to stay in the green at 2.12% return for the year. This is even after a current month that is not helping returns with a loss of -6.47% so far. Health Care also moved to the loss side and now stands at -0.70% for the year.

Bonds have not escaped the carnage with every major U.S. category at a loss year-to-date. The biggest hit was experienced in investment grade corporates with a loss of -3.57% followed closely by high yield corporates giving up -2.65%. Unfortunately, for the bond asset class, every category is also in a loss position for the past 12 months except for Municipals with a slight gain of 0.23%.

So where is the good news?

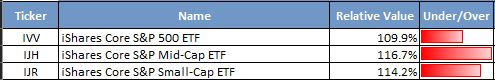

U.S. LargeCap relative valuation has moved back to 109.9% Fair Value (109.9% Fv) well off of the previous cautionary level (120% Fv +). MidCap had moved solidly into overvaluation (130.0% Fv +) earlier in the year, and has come back to 116.7% Fv which is closer to the norm for the category’s market capitalization. SmallCap has also retreated back to a normal level of 114.2% Fv.

This gives all three market capitalization areas greater flexibility to move in either direction as stocks strive to meet expectations. Expectations remain high, but not at such previous, unreasonable, levels.

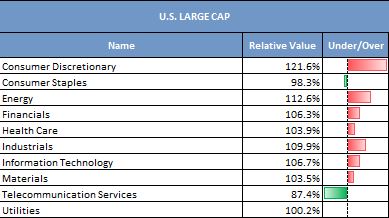

LargeCap sectors are all now below an overvalued level and only one, Consumer Discretionary, is at a cautionary level. And, that is just barely above the 120% Fv level at 121.6% Fv. Energy is now at 112.6% Fv and well within normal.

All of the remaining eight individual sectors are within 10 percentage points of 100% Fv. This is a much improved position than during the past six months. Previous expectations we unreasonably high and have now adjusted to a more reasonable level.

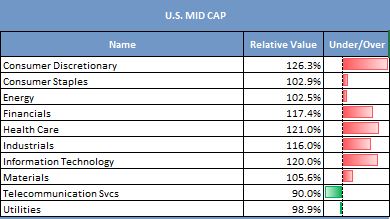

MidCap sectors are all out of overvaluation ranges, but remain in cautionary range. However, all three have eased back toward fair value ranges which is an improvement. Consumer Discretionary has moved out of overvalued range. Health Care moved down to a lower level of caution at 121.0% Fv and Technology is just at the edge of cautionary at 120.0% Fv. All three have received welcomed relief. The remaining sectors are all in normal valuation ranges with Telecom and Utilities both slightly undervalued.There has been an increase in the last several days of MidCap stocks being considered on the Buy Watch list as they drop below 80% Fv.

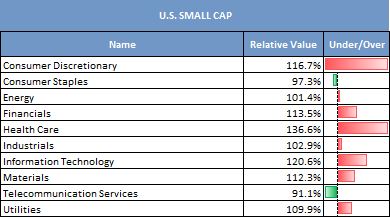

SmallCap sectors have also improved, but one, Health Care remains overvalued at 136.6% Fv. Even though high, it is much improved over the earlier level of 140.7% Fv. Health Care remains an area of high valuation across both MidCap andSmallCap market capitalization categories. Outside of Health Care the remaining SmallCap sectors are well positioned in valuation. Consumer Staples and Telecom both are under 100% Fv and only Tech is just on the edge of cautionary and fair at 120.6% Fv. Energy and Industrials are both very near 100% Fv.

market capitalization categories. Outside of Health Care the remaining SmallCap sectors are well positioned in valuation. Consumer Staples and Telecom both are under 100% Fv and only Tech is just on the edge of cautionary and fair at 120.6% Fv. Energy and Industrials are both very near 100% Fv.

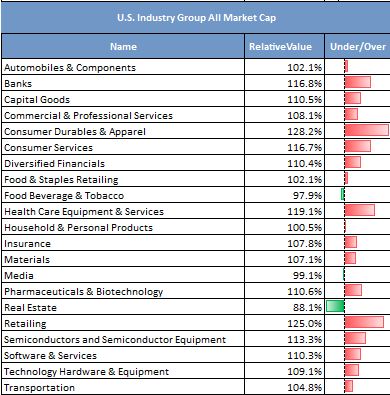

Industry Group valuations offer a more specific view and we see improvement here as well. Only Real Estate was under 100% Fv previously. There were two industry groups considered overvalued and seven in cautionary territory. Now no industry group is overvalued, and two are in cautionary territory. The two that are in cautionary territory are Consumer Durables & Apparel at 128.2% Fv, and Retailing at 125.0% Fv. Retailing was at 135.2% Fv earlier and Consumer Durables & Apparel was at 144.4% Fv. Both are much improved from earlier in the year in terms of valuation pressures.

Over 90% of the industry groups are now within normal fair value range. This is an excellent improvement from the previous environment where nearly each sector was reaching new highs in terms of relative valuation. Higher

relative valuations are good until they reach cautionary levels. This is when actual fundamentals must improve to meet expectations. Once expectations exceed actual fundamentals and reach 130% Fv +, the probability of a correction increases. Currently, the probability of a continued correction is lower than before, and much improved probability exists for an improving market. There are some areas of caution, such as in SmallCap Health Care where relative valuations are still high indicating a low probability that higher values will be experienced. The probability that a reduction, or pause in values is high in that category and sector.

relative valuations are good until they reach cautionary levels. This is when actual fundamentals must improve to meet expectations. Once expectations exceed actual fundamentals and reach 130% Fv +, the probability of a correction increases. Currently, the probability of a continued correction is lower than before, and much improved probability exists for an improving market. There are some areas of caution, such as in SmallCap Health Care where relative valuations are still high indicating a low probability that higher values will be experienced. The probability that a reduction, or pause in values is high in that category and sector.

Valuations are better today. Now we need to see if panic selling continues, or if more rational heads prevail.