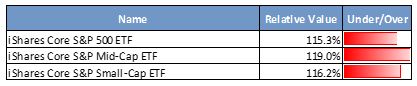

LargeCap, MidCap & SmallCap all move back toward Fair Value range

After a nice rationale correction in February, the market decided to continue into March on the same objective. LargeCap stocks have repositioned themselves better and remain well in fair value range at 115.3% a drop of just over 1 percentage point. MidCap stocks have moved well below their previous cautionary levels to 119.0% Fv. This is a welcome drop of over 6 points back into fair value range. MidCap also retreated away from caution and now sits within fair value at 116.2% Fv. This was a drop of 6.1 points. All three market capitalization categories are now back within fair value. These relative valuations are closer to a normal market.

We would prefer that all three market capitalization categories stay in fair value range for the rest of the 1st quarter. We realize this is not want many investors are seeking as they wish to instantly recover from the February drop, but letting fundamentals catch-up to market expectations would reap long-term benefits.

We are doubtful the market can support the MidCap classification being so close to the Cautionary range until more favorable economic conditions surface. With GDP remaining

below 3% and the uncertainty of a new Federal Reserve Chair (bond values concern), a wait-and-see attitude may easily prevail for some time. We noticed the new Fed Chair has made the usual mistake, that all new Chairs make by the way, of beginning their term by speaking “freely” in front of Congress until they realize a small misplaced word, or uncomfortable expression, can turn into a billion-dollar market movement. Remember, this is the same group that used to judge the tone of the meeting by the size of Alan Greenspan’s briefcase when he arrived. We expect to begin hearing standard “fed-speak” within a few weeks from Chair Powell and global markets will be relieved. Or, at least bored once again.

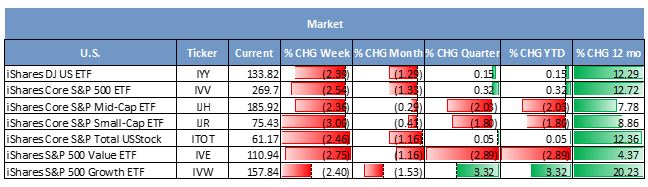

All of the domestic market performance measurements remain in the green for the past 12 months, and the general market remains positive for the year-to-date. We have added two new market measurements to the table. Both, LargeCap Value and LargeCap Growth indices are now included.

We added these indices because there is a wide divergence between value and growth performance, so far. Value has been taking the brunt of the recent correction with a loss of nearly 3% while growth has increased just over 3%. MidCap and SmallCap have also lost about 2% this year, but remain positive over the previous 12 months.

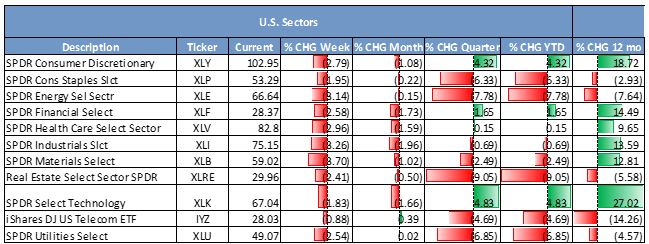

Not all sectors have been as fortunate to remain positive for the past 12 months. We now have five sectors seeing red and seven in the red for the year. The Financial sector is being saved from negative numbers by the fact real estate was pulled out of the category this year. Real Estate is suffering the largest loss of all sectors, just over 9%. This also explains why so many Real Estate stocks are now included in the Buy Watch considerations list. The only real gains this year are in Consumer Discretionary and Technology, both just short of a 5% gain for the year.

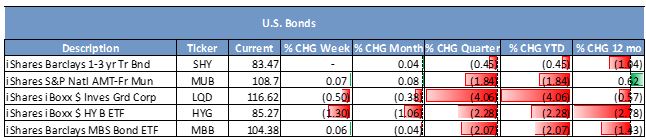

Bonds have not been spared a dose of red ink in 2018 with all domestic categories feeling the pain. The biggest drop has come from investment grade corporate bonds giving up over 4% in the year. Over the past 12 months every bond category is negative except for Municipals and only by the thinnest of margins, 0.62%.

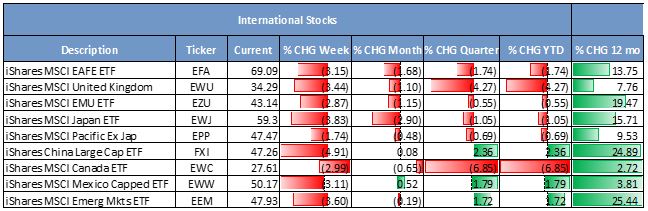

The negative numbers have spread throughout the global markets with all but China, Mexico and Emerging Markets. These three are the only areas with positive numbers this year.

After a stellar 2017 the current year is not starting off with the same enthusiasm. In many cases, market expectations are far ahead of fundamentals. We may need to wait until reality can catch up to hope. This is not uncommon and has been repeated throughout history. The press can blame trade complications, BREXIT, Russian hack attacks or the Olympics, but there is usually a performance discomfort when expectations are so high.

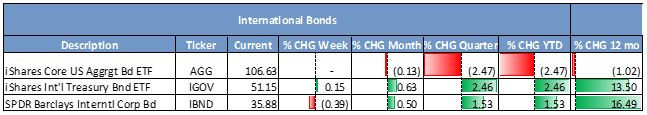

For a USD based investor, one of the few positive places for performance has been sovereign debt and international corporate bonds. Both, are experiencing gains in excess of 1% while the broader measure, Aggregate, is not have a good year so far, slipping over 2% and still struggling over the past 12 months.

There has been a reversal of the move toward Sell and Sell Watch consideration stocks toward Buy and Buy Watch consideration stocks. This is a result of the February drop and increasing economic strength throughout the world. SELL and SELL WATCH has stopped advancing and stabilized at just above 18% while Buy and Buy Watch classifications have grown to 6.6%.