Investors are optimistic. Are they too optimistic, or, just early?

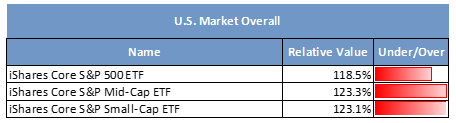

MidCap and SmallCap market capitalization stocks both moved into cautionary territory while LargeCap is just 1.5 Fv points away. Granted, the world political threat environment has changed significantly with, what appears to be, the first time since the Korean Conflict North Korea, South Korea and the United States will be discussing normalizing their relationship. Local and regional conflicts are also near all-time lows. Can you imagine the thoughts of what could

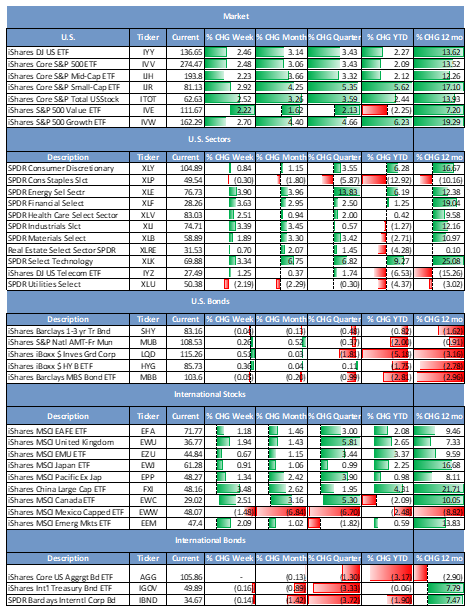

happen if you were investing in 1914, 1940, 1950, 1960 (WW-I, WW-II, Korea, Vietnam). Compared to those time periods, current political tensions should support higher fair values. Economically, the unemployment rate is at dream levels, 3.9% declaring the employment situation is at full employment. Inflation is much lower than economists expected and has even slowed down from an earlier anemic 3.1% to 1.8%. This is giving the Federal Reserve Board ulcers because this is uncharted territory, low unemployment is supposed to bring about higher inflation, that is just how it works. The stock market should be ecstatic, but has only been able to produce a 2.44% increase (AllCap) on track to a below average year. So, what is happening?

We live in a consumer economy built on the service industry. The consumer is struggling to become part of the value equation. As an employee they are being hired at record rates and are able to keep their job better than ever before, but the salary/pay scale is not improving nearly as fast as the overall economy. Average weekly earnings are only up 0.2% year-over-year. Purchasing power only increased previously due to lower energy prices and more recently due to tax adjustments. Unfortunately, energy prices are starting to rise.

Much is being done for the manufacturing industry, which is helpful on a global competitive platform, but don’t forget we are a services based economy. Certainly, all industries benefit from recent tax changes and they need some time for adjustment. The adjustment has primarily been used to bolster share prices which is certainly enjoyable. Going forward some of the benefit has to begin to filter into the employment situation. Employees should not be seen as just a component of the service and manufacturing equation. Employees need to benefit from the favorable economic environment or the value added will deteriorate. If the C-Suite justifies receiving above-average compensation based on their pier group, why do they then use “market averages” to create their salary/pay ranges for the rest? Would this not build a wide gap between the two groups over time?

This year, 2018, may be the year of adjustment. Adjustment to a beneficial economic and world political environment and eventually benefit to employment in terms of income so that purchasing power increases both domestically and globally.

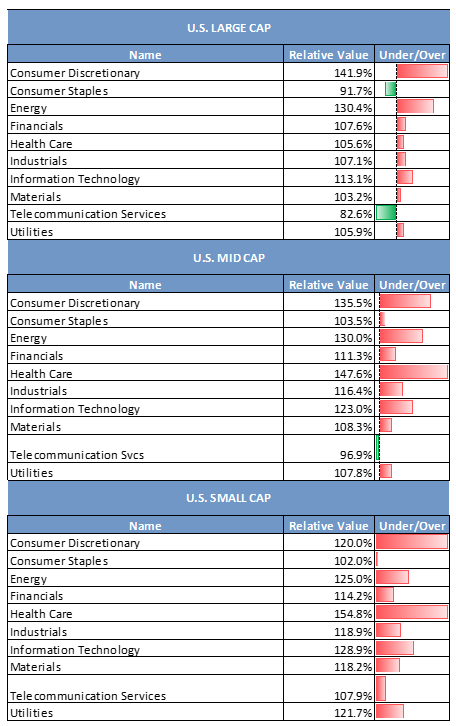

Two LargeCap sectors posted the largest increases recently, Consumer Discretionary gaining 13.0 points while Energy beat that with a gain of 17.6 points. Both are in overvalued territory at 141.9% Fv and 130.4% Fv, respectively. All of the other LargeCap sectors are within normal valuation ranges (120%Fv – 80% Fv). Only two LargeCap sectors gave up relative value, Consumer Staples, which has struggled all year and Telecommunications.

MidCap also had two big gainers, Energy added 20.3 points and Health Care moved up 17.6 points to 147.6% Fv. Health Care is obviously overvalued and it is joined by Consumer Discretionary at 135.5% Fv and Energy at 130.0% Fv). MidCap Telecommunications joined their LargeCap family giving up 6.6 points and moving undervalued to 96.9% Fv.

SmallCap now has all sectors above 100.0% Fv, or Perfect Fair Value (PFv). Consumer Staples moved to the positive side reaching 102.0% Fv.The largest gain was made in Energy by adding 22.9 points to 125.0% Fv It is now in caution range and joined by Consumer Discretionary at 120.0% Fv, Information Technology at 128.9% Fv and Utilities at 121.7% Fv. Health Care is well overvalued at a whopping 154.8% Fv.

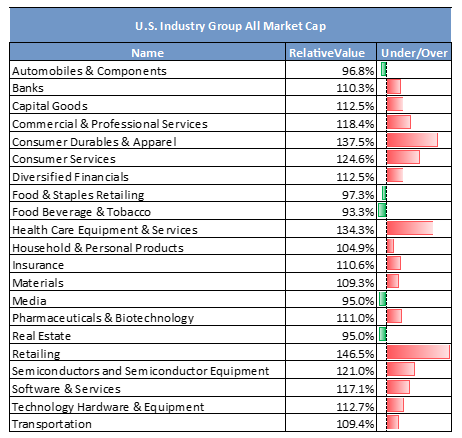

Only two industry groups moved more than 10 Fv points. Health Care Equipment & Services advanced 12.3 points to 134.3% Fv and Retailing gained 13.4 points reaching 146.5% Fv. This places retailing into overvaluation along with Consumer Durables & Apparel at 137.5% Fv. There are two additional industry groups in caution territory, Consumer Services at 124.6% Fv and Semiconductors at 121.0% Fv.