Finally a Week in the Green

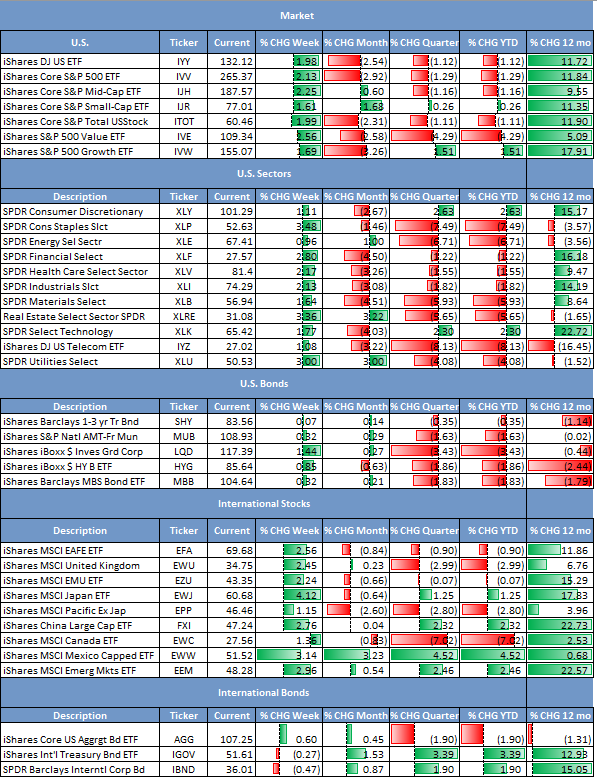

It feels like it has been a long time since we experienced a week where most of the changes in values were green, but it really hasn’t been that long. This week, everything was green for the week, and for the past 12 months we remain in the green and above long-term averages for all stock categories. Even SmallCap is in positive territory for the week, month, quarter and past 12 months. MidCap stocks took the lead posting a gain of 2.25%, followed closely by LargeCap stocks at 2.13%.

Sector performance also posted solid green with Consumer Staples and Utilities both moving above 3.0%. Consumer Discretionary is in the lead for the year at 2.6% and Technology is not too far behind at 2.3%. Even with the good week for LargeCap sectors, it is important to keep in mind the fact that year-to-date, these 2 are the only sectors in the green. The remaining eight sectors are all red with Telecom well down at 8.13%, but at least it had a positive week and economic support remains positive.

Sector performance also posted solid green with Consumer Staples and Utilities both moving above 3.0%. Consumer Discretionary is in the lead for the year at 2.6% and Technology is not too far behind at 2.3%. Even with the good week for LargeCap sectors, it is important to keep in mind the fact that year-to-date, these 2 are the only sectors in the green. The remaining eight sectors are all red with Telecom well down at 8.13%, but at least it had a positive week and economic support remains positive.

Global stock markets were also positive for the week with Japan adding over 4% and Mexico advancing over 3%.

Sector performance also posted solid green with Consumer Staples and Utilities both moving above 3.0%. Consumer Discretionary is in the lead for the year at 2.6% and Technology is not too far behind at 2.3%. Even with the good week for LargeCap sectors, it is important to keep in mind the fact that year-to-date, these 2 are the only sectors in the green. The remaining eight sectors are all red with Telecom well down at 8.13%, but at least it had a positive week and economic support remains positive.

Global stock markets were also positive for the week with Japan adding over 4% and Mexico advancing over 3%. All global markets remain positive over the previous 12 months. Year-to-date values are mixed with Japan, China and Mexico all positive. The U.K. and European developed markets are struggling along with the rest of the Pacific (X-Japan) and Canada. America’s friend to the north is suffering with over a 7% decline so far this year.

The bond market shifted into the green this week and investment grade corporates finally kicked the gloomy winter with a 1.4% gain. International bonds gave up earlier year gains with minor declines of less than 0.5% and keeping the positive results for the month, quarter and year.

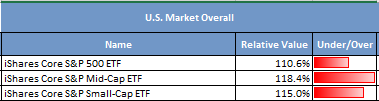

Valuations moved closer to 100% fair value (Fv). LargeCap is only 10 points away from this level. MidCap stands at 118.4% Fv with SmallCap at 115.0% Fv. There is a very good probability that the S&P Index (IVV) could reach $285/share over the next 12 months which places the DOW around 26,100. The easing of overvaluation pressure that has taken place in the first quarter of this year can support a return of higher stock market gains with support from favorable economic conditions. If these levels are reached it still places the market inside normal valuations and below the Cautionary valuation level. SmallCap index (IJR) has a strong likelihood of reaching $83/share and MidCap $201/share. They both may have a bumper ride than LargeCap because these values place them just inside the Cautionary level. However, if LargeCap supports the climb, it is highly likely the Mid and SmallCap segments will also reach these levels.

Valuations moved closer to 100% fair value (Fv). LargeCap is only 10 points away from this level. MidCap stands at 118.4% Fv with SmallCap at 115.0% Fv. There is a very good probability that the S&P Index (IVV) could reach $285/share over the next 12 months which places the DOW around 26,100. The easing of overvaluation pressure that has taken place in the first quarter of this year can support a return of higher stock market gains with support from favorable economic conditions. If these levels are reached it still places the market inside normal valuations and below the Cautionary valuation level. SmallCap index (IJR) has a strong likelihood of reaching $83/share and MidCap $201/share. They both may have a bumper ride than LargeCap because these values place them just inside the Cautionary level. However, if LargeCap supports the climb, it is highly likely the Mid and SmallCap segments will also reach these levels.

LargeCap sector valuations improved to support a return to higher stock prices except for Consumer Discretionary with a fair value of 128.9%. This will put the sector solidly in Cautionary territory and dangerously close to Overvaluation. The remaining sectors all are well within normal valuation ranges. Seven sectors moved closer to 100% Fv.

MidCap sectors remain slightly tilted to the overvaluation side of the balance.

MidCap sectors remain slightly tilted to the overvaluation side of the balance.

MidCap sectors remain slightly tilted to the overvaluation side of the balance, but primarily due to two sectors that are overvalued, Consumer Discretionary and Health Care, both over 130% Fv. The remaining sectors are all well within normal valuation ranges with half under +/- 10 points of 100% Fv.

SmallCap Health Care is overvalued at 136% Fv and SmallCap Technology is just inside the Cautionary valuation mark at 123% Fv. The remaining sectors are in good positions.

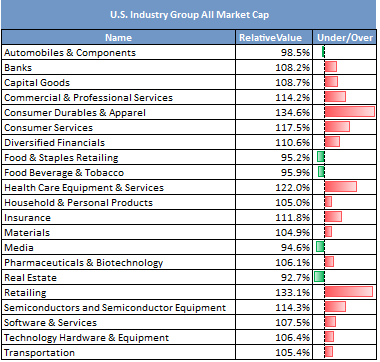

Industry groups also improved over the week with 2 groups overvalued and only 1 at Cautionary level. Consumer Durables & Apparel reached 135% Fv and Retailing 133% Fv. Food & Staples Retailing moved from slightly overvalued to slightly undervalued being one of the 5 undervalued industry groups.