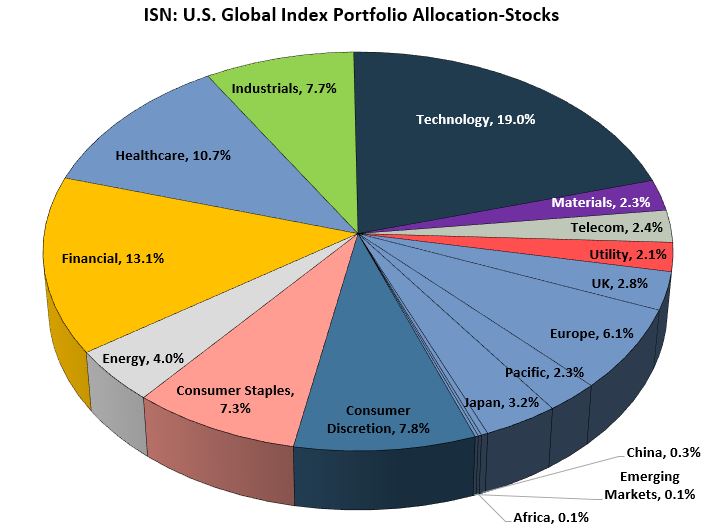

Allocation Considerations for U.S. LargeCap, MidCap & SmallCap remain close to previous allocations.

An indexed portfolio is one of the most efficient methods of providing an investor the broadest exposure to the market for targeted or smaller size accounts.

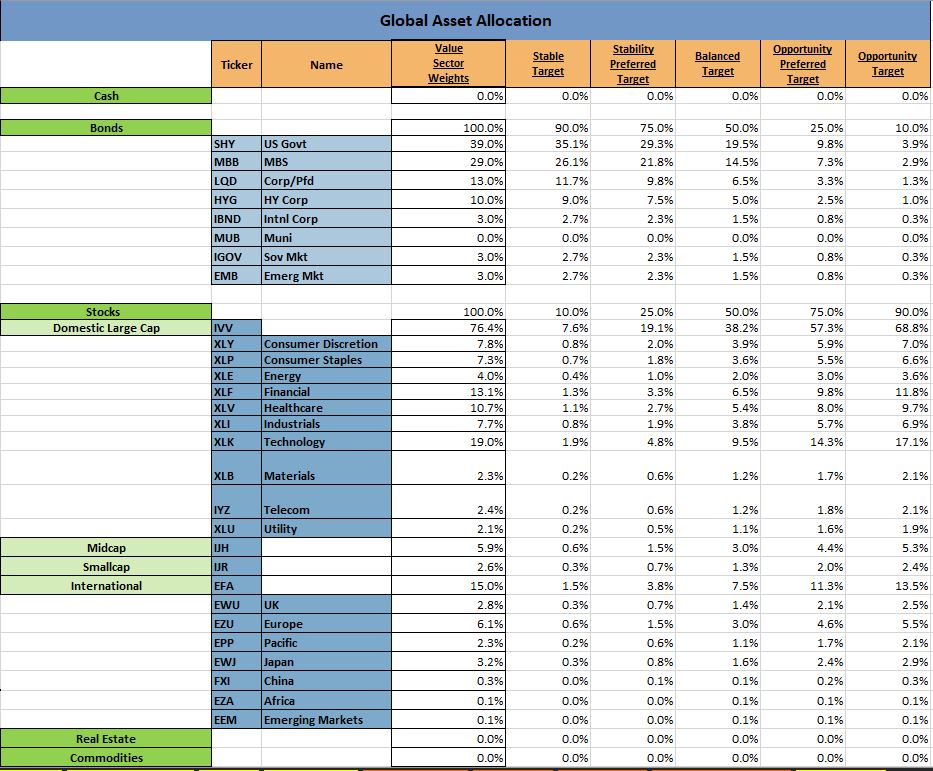

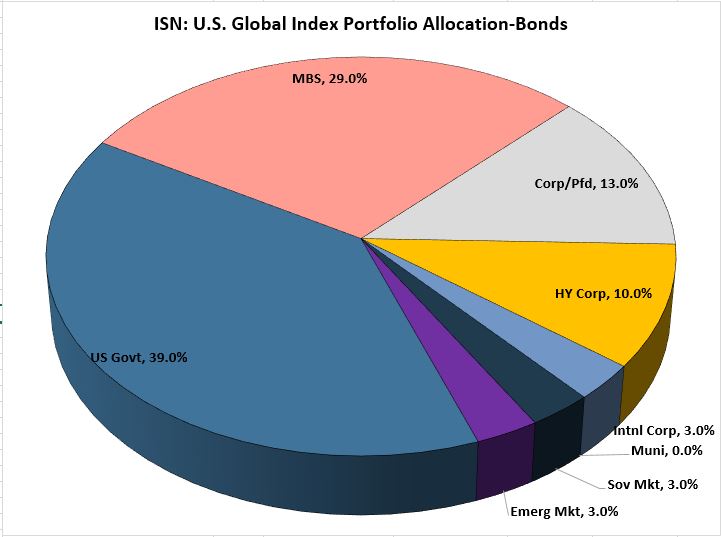

The table in Figure 1 is an asset allocation consideration that uses individual index securities for global coverage. The allocation amongst the index securities is determined by using the relative fair value for each domestic sector, domestic market capitalization, international market and bond classification. Overvalued areas have a lower allocation while undervalued areas receive a higher allocation. Bond allocations are determined on a market weight, relative yield and long-term average return basis.

The Balanced Target is the most representative of the market overall under current and future conditions and will experience an expected return and yield that is closest to the global market. If an investor is seeking greater stability in the value of the portfolio over time, then consideration should be given to the two columns to the left of Balanced Target. The most stable allocation potential is labeled Stable Target. The expectation is that this allocation will provide the most relative stability under most conditions. This is not the same as security. If an investor is seeking complete security a reasonable consideration would be to ladder a series of CDs across many financial institutions such as banks, and continue to roll each CD into a new CD as they mature.

When central bankers reduced interest rates to zero or below, yields dropped and so did income that was generated from a bond portfolio. Asset allocations shown in Figure 1 have recently started to move back to including government bonds because interest rates are expected to continue to move upward at a slow pace and eventually return to normal.

However, the current bond yields are well below the historical norm of 4% to 5% annually. Many stock yields are above current government bond yields and present a greater opportunity for income generation. The difference between bonds and stocks in this type of environment will be centered on the relative value of the overall asset, stock versus bond, at any given point in time.

One thing that zero interest rates have taught investors is that bonds are no different than stocks prior to the maturity date. The value of the bond security is only what another investor will pay at that time. If you own a low yielding bond when interest rates are rising, expect to receive less now than the expected value at maturity. If you paid a premium for the bond, expect to take a loss on the price, even at maturity.

Bonds do not equal income, nor do stocks equal growth. There are close correlations to each objective overtime, but conditions change and every investor should consider the current and expected future environment over several time frames. This is why we classify the various asset allocation considerations starting at Stability moving to Opportunity. We believe it is a better descriptor than value and growth, especially in varying interest rate environments. There are three general themes throughout the global asset allocation consideration. First, bonds will provide greater asset value stability in most economic conditions if the securities are held to maturity, a condition that creates a forced sale does not arise and bonds are NOT bought at a premium. Consideration should be given to not buying a bond at a premium because as soon as you start making relative valuations between, purchase price, yield, timeframe and maturity you are entering the world of active bond management and fluctuations in overall value timing must be included.

Second, stock prices will fluctuate more than bond prices over time and present a relative higher future opportunity over bonds. Stocks can also generate income if the portfolio is tilted to dividend paying stocks that are greater than the respective bond and/or market.

Third, international markets add a consideration of currency risk which can increase fluctuations in security values and should be held in relative smaller allocations if stability is preferred.

All of the asset allocations discussed follow the same basic themes so that a global asset allocation can be further segmented into domestic stocks down to the market capitalization, domestic sector and industry group if desire.

Column Definition

Asset Classification – indicates the major asset classification.

Ticker – this is the ticker assigned to a representative index security that is tradable in the market and fully replicates the respective category.

Name – the name associated with the market from column one.

Stable Target – is the allocation and investor might consider to secure the most stable value in the portfolio.

Stability Preferred Target – the balance between value stability and future opportunity is tilted toward stability but, there is a willingness to give up some stability to gain future opportunity.

Balanced Target – places equal weighting on stability and future opportunity in the portfolio overall value.

Opportunity Preferred Target – consistency in the portfolio value is important but, the desire to hopefully obtain future opportunity is of higher importance.

Opportunity Target – places the most importance on potential future opportunity and the investor should be ready to accept significant movement in especially month-to-month and even year-to-year values. The desire is to achieve longer term higher values and an acceptance of greater price fluctuations.